The newly imposed tariffs risk triggering job losses, reducing purchasing power, and slowing down construction. With rising inflation and stagnant wages, more and more Canadians will struggle with housing affordability, putting additional pressure on the community housing sector.

The duration and full impact of this tariff war remain uncertain, but it has already exposed vulnerabilities in the Canadian economy. As a key piece of infrastructure, community housing has the potential to stabilize the market, protect both the middle class and vulnerable households, and strengthen economic resilience.

Tariffs that impact housing affordability

Tariffs on essential materials such as lumber and steel are driving up the costs of construction, maintenance, and renovations. Prices, already on the rise in recent years, are expected to climb further, affecting the financial feasibility of many projects. At the same time, supply chain disruptions and increased competition for materials will delay construction timelines, exacerbating the existing housing crisis.

These costs will force more households into precarious or unaffordable living situations—or even homelessness. Meanwhile, unemployment could surge. The Canadian Chamber of Commerce estimates that 2.3 million jobs depend on exports to the United States. Provincial projections suggest that up to 450,000 jobs could be lost in Ontario, 160,000 in Quebec, and 120,000 in British Columbia.

This wave of job losses would further strain an already insufficient stock of affordable housing. Coupled with soaring consumer prices it would put even greater financial pressure on middle- and low-income households, amplifying economic insecurity.

Leveraging community housing to absorb the shock

Unlike the private market, where investment decisions are driven by economic cycles, community housing operates on a long-term model that ensures affordability regardless of market conditions. Expanding our sector would help mitigate rising costs and bring stability to the housing market.

Strengthening financing tools and preservation initiatives, such as the Rental Protection Fund in British Columbia and the Community Housing Capital Fund in Nova Scotia, would help cushion the impact of tariffs on households. By preserving affordable units, this approach would reduce the risk of financial hardship and evictions.

Similarly, increasing the supply of community housing would provide much-needed stability in a time of economic uncertainty. At the same time, it would support local economies by preserving household purchasing power and reducing the strain on emergency services.

An underestimated economic lever

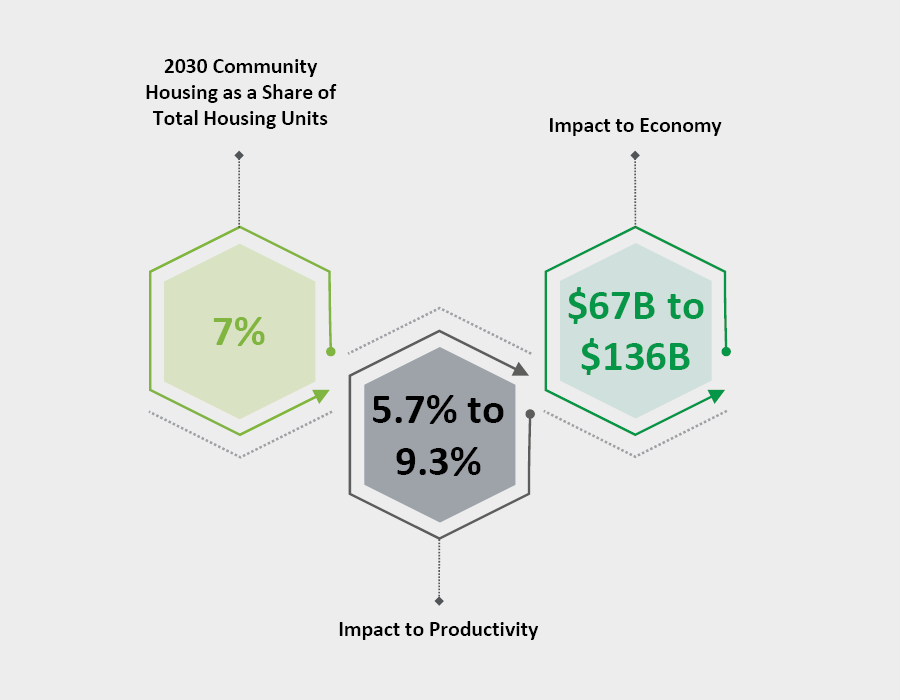

The economic benefits of community housing are well documented. A study by CHRA and Deloitte found that doubling its community housing stock, Canada could boost economic productivity by 6% to 9%, translating to a $67 billion to $136 billion increase in GDP. These gains alone could offset the projected 2% to 5% GDP contraction caused by tariffs (averaging approximately $83 billion).

In some regions, a lack of affordable housing is already hindering business expansion. Rising construction costs will only make this problem worse. Expanding community housing could help counteract economic decline and support local businesses.

Far from being a cost, investment in community housing is an economic driver. It should be considered essential infrastructure, on par with roads and public transit.

Protecting affordable and community housing

The quantity of affordable housing units under private sector ownership has been experiencing a prolonged decline. Property owners often turn to solutions such as increasing rent or divesting themselves of affordable properties to owners intent upon conversions to more costly rentals or condos. The drive to compensate for the economic pressures caused by tariffs is likely to accelerate this process.

Meanwhile, the nonprofit and cooperative housing sector faces growing financial strain. Unlike for-profit landlords, community housing providers cannot simply raise rents to offset rising costs.

Several measures could help mitigate the impact of tariffs:

- A temporary tariff exemption for nonprofit housing projects to limit cost increases.

- A rent stabilization fund to prevent cost increases from being passed on to vulnerable households.

- Expanded financing programs, such as an increase in the Housing Accelerator Fund, to keep projects viable despite economic challenges.

- The immediate release of the previously announced $4 billion Indigenous Community Housing Fund to address urgent housing needs in Indigenous communities.

- The creation of more provincial and territorial housing acquisition funds to keep rental units affordable by removing them from the speculative market. A swift rollout of the federal $1.5 billion acquisition program would provide immediate relief. These funds would also keep housing stock under Canadian ownership, limiting the influence of foreign investors—who are predominantly American.

An opportunity in the face of challenges

Community housing is a cornerstone of economic and social stability. By fully integrating it into investment strategies and removing barriers to its expansion, policymakers could reshape the housing market for long-term inclusive and resilient growth.

While tariffs will undoubtedly make housing affordability even more challenging, they also highlight the strategic importance of community housing. With targeted policies, Canada can both mitigate the immediate impacts of rising costs and strengthen the country’s long-term economic resilience.