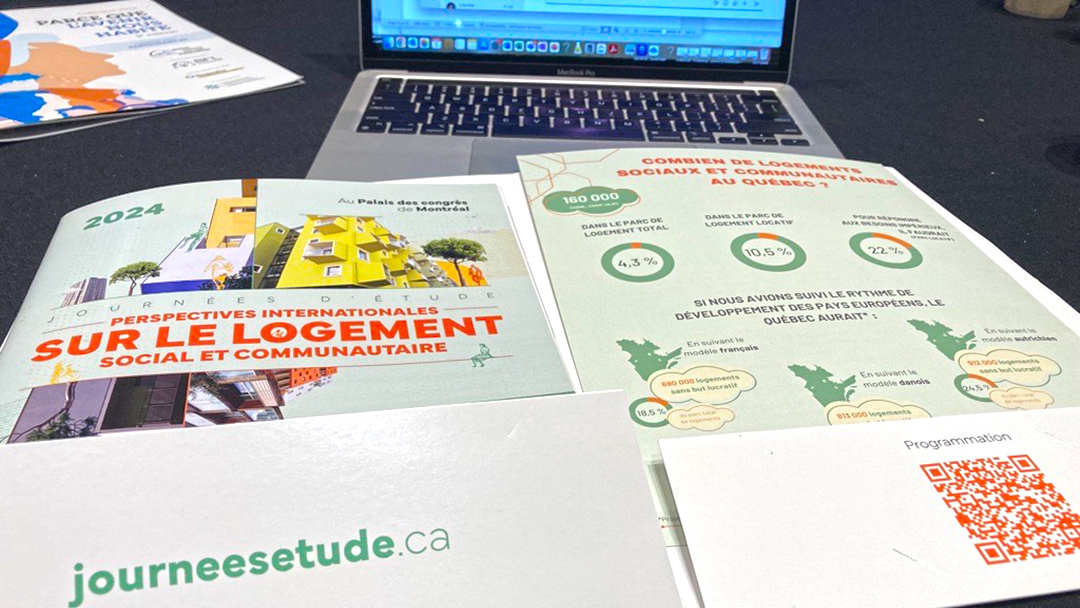

The recent Journées d’étude internationales sur le logement social et communautaire in Montreal gathered numerous Quebec leaders from the community housing sector, united by a common goal: to find sustainable solutions to enhance the Quebec model by drawing inspiration from international success stories.

The Centre was pleased to contribute to this initiative by promoting the cultural transformation of the sector as a key element.

Below is our summary which draws chiefly on the report produced by the Fédération des OSBL d’Habitation de Montréal (FOHM).

Inspired by international funding models

During the study days, discussions highlighted several funding models from European countries that have achieved much higher proportions of social and community housing compared to Quebec. Most notably, France, Denmark, and Austria provided proven solutions that have facilitated the creation and maintenance of a substantial number of non-profit housing units as a percentage of overall market share.

France’s Union Sociale pour l’Habitat (USH) brings together several types of non-profit housing organizations. This organization coordinates and supports the sector in achieving its objectives for the development of social housing stock.

USH also offers a unified governance structure that ensures continuity of funding, demonstrating the importance of a stable, centralized governance model. This concept could solidify the Quebec model, which, in contrast, is currently fragmented among several types of structures.

The Danish model is characterized by nationalized mortgage financing, managed by the Central Bank of Denmark. This system ensures the stability and autonomy of the social housing sector in the face of economic fluctuations.

Denmark has enabled social housing organizations to take out loans at exceptionally low rates, thereby supporting the long-term development of affordable housing. This model could provide inspiration in Quebec, where reliance on banks and their often higher rates poses a major challenge for community players.

Finally, in Austria, the financing model is based on a revolving financing system that ensures stable, sustainable funding, enabling repayments to be reinvested in new social housing projects.

Cooperatives also play a significant role in the provision of affordable housing. These cooperatives benefit from long-term government support, enabling them to develop projects and keep them out of the speculative market. This cooperative model demonstrates the importance of supporting local initiatives and ensuring a sustainable vision for the community housing sector.

The province of Quebec, home to half of Canada’s housing cooperatives, could learn from this model, particularly by strengthening financial support and training to foster their growth and resilience.

Blueprint for Quebec

The insights gained from these international models highlight clear pathways for improving the Quebec model. These strategies aim not only to increase the number of social and community housing units but also to fundamentally transform the sector, making it more autonomous, resilient, and capable of adopting entrepreneurial approaches.

” We need to get back to more flexible and innovative program measures that better consider the social dimensions and diverse situations.”

André Fortin – Strategic Advisor, Caisse d’économie solidaire Desjardins

Establishing a resilient funding system is crucial for the sector to safeguard against economic fluctuations and changes in government. European examples show that a sustainable funding system in Quebec would require close collaboration among various levels of government to ensure program consistency and investment predictability. This approach would also allow organizations in the sector to plan their projects on a long-term basis, independent of political cycles or short-term programs.

Setting a target of 20% for social and community housing in the rental stock over the next fifteen years is both a significant challenge and a necessity to meet the needs of today’s population. To reach this goal, Quebec will need to build or acquire approximately 10,000 to 12,000 housing units annually if only to enhance stability for the most vulnerable households. Inspired by the success rates in France and Denmark, this objective could be achieved by mobilizing municipalities and adapting regulations to support this development.

Creating a revolving fund, similar to Denmark’s model, would allow the sector to reduce its dependence on traditional financing and bank loans, which are often less favorable. This fund could function on the principle of capital recycling, where interest and capital are reinvested into developing new housing. Such a funding mechanism could also attract partnerships with foundations and investors who prioritize social returns, fostering a sustainable business model.

Finally, revising the accessibility criteria for community housing to include households of various income levels would enhance equity and diversity within the sector. Expanding these criteria would allow for the accommodation of both low- and middle-income households, while still prioritizing the most vulnerable. This balance between social mix and accessibility could serve as a catalyst for gaining acceptance of new projects and solidifying the community housing model as a cornerstone of social development.

Transforming the culture of the community housing sector

The international study days showcased inspiring financing models where community players leverage revolving funds and private partnerships. This capacity to diversify resources and innovate is crucial for Quebec, where achieving 20% of the rental stock market share through social and community housing requires a long-term vision.

“There is a strong desire among Quebec’s partners to advance further and see this housing stock expand and play a significant role. […] The sector is truly prepared and capable of finding solutions.”

Chantal Desjardins, General Manager, FOHM

For the Centre, it is crucial that the sector undergoes a cultural transformation to become stronger and more resilient. We must foster innovation, boldness, and proactivity to reinvent financing methods.

To increase the community’s share of Quebec’s residential rental market from the current 7% to 20% within 15 years, we need to multiply initiatives like the PLANCHER Fund. Developing business models that provide the community sector with the same agility as the for-profit sector is essential.

This will allow the sector to position itself as an innovative and proactive player, capable of leading the response to the housing crisis and transforming housing on a national scale. Simultaneously, it will reduce its dependence on public subsidies and political changes.

We invite you to read the full report of the study days here (in French only).